Straight line depreciation is a small business accounting procedure. This helps accountants and small business owners calculate exactly how much needs to be taken out of the expense on a yearly basis. When it comes to tax time, you will more likely be prepared to perform necessary tasks prior to filing.

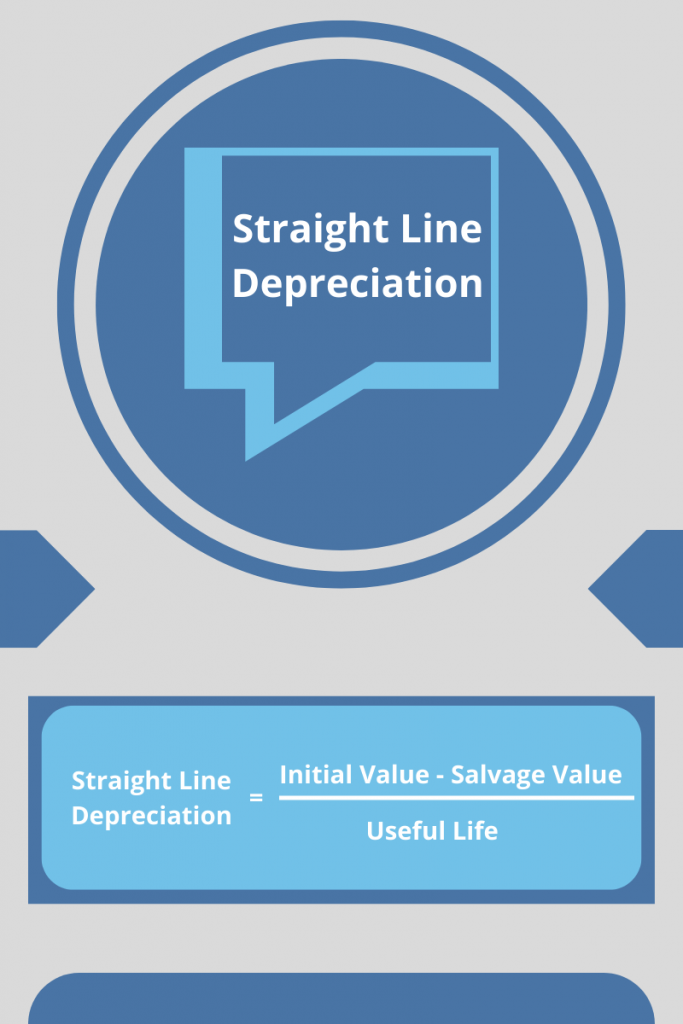

Formula

Depreciation of physical assets may be well represented by straight-line depreciation. For example, a truck or piece of machinery is used and over time generally loses its value at a steady rate. This may be due to regular wear and tear, market conditions, or other factors.

The formula to calculate the straight line depreciation expense is “straight-forward”. First, subtract the salvage value from the initial value of the asset. Then, divide the difference between the two values by the useful life in years. This figure is your depreciation expense.

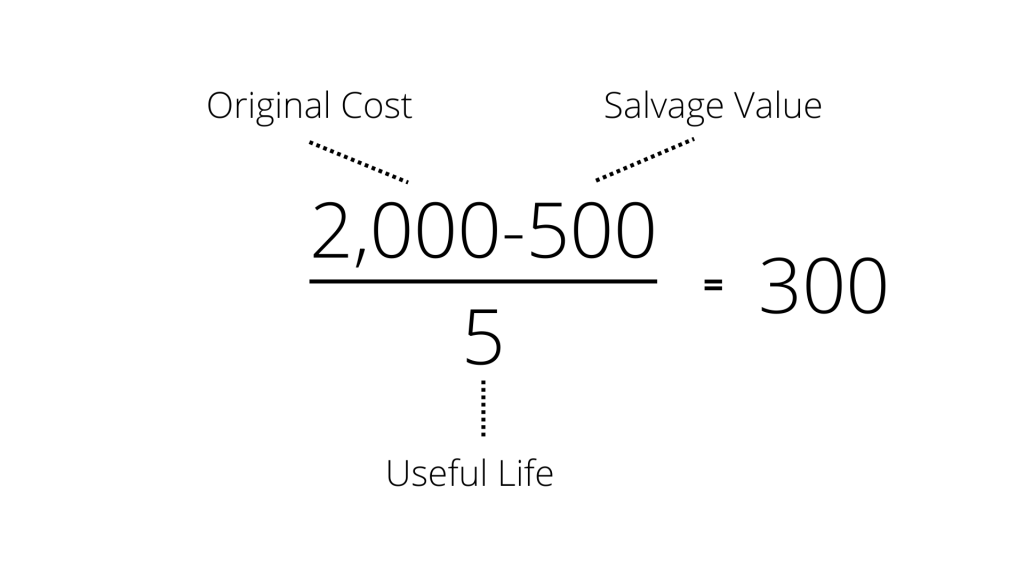

Example

For example, if you bought a trailer for your business, let’s say the trailer costs $2,000, the salvage value is $500, and the useful life is 5 years. Using the formula above, it would look like this:

Wrap Up

Be sure to speak with your accountant when your business acquires new equipment and assets. It’s important for your accountant to have these numbers in order to better understand your accounting needs and what is applicable to your business. When you have doubts or questions about the values of your assets, schedule a meeting with your accountant to discuss these questions and find solutions as soon as possible.